The financial services industry is undergoing a significant transformation, driven by the rapid evolution of technology. AI and GPT innovations are at the forefront of this change, reshaping wealth and asset management in unprecedented ways. This article explores how AI is revolutionizing this sector, highlighting its applications, benefits, and future prospects.

AI in Finance: A Strategic Transformation

AI’s integration into finance signifies a strategic shift, transcending mere technological adoption. Financial institutions leveraging AI are seen as innovators and technology leaders. This enhances brand reputation, attracts desirable customers and partners, and increases value to investors. Key applications of AI in finance include:

- Personalizing customer interactions.

- Detecting fraud and improving KYC processes.

- Streamlining portfolio management and compliance reporting.

- Enhancing digital assistants in client services.

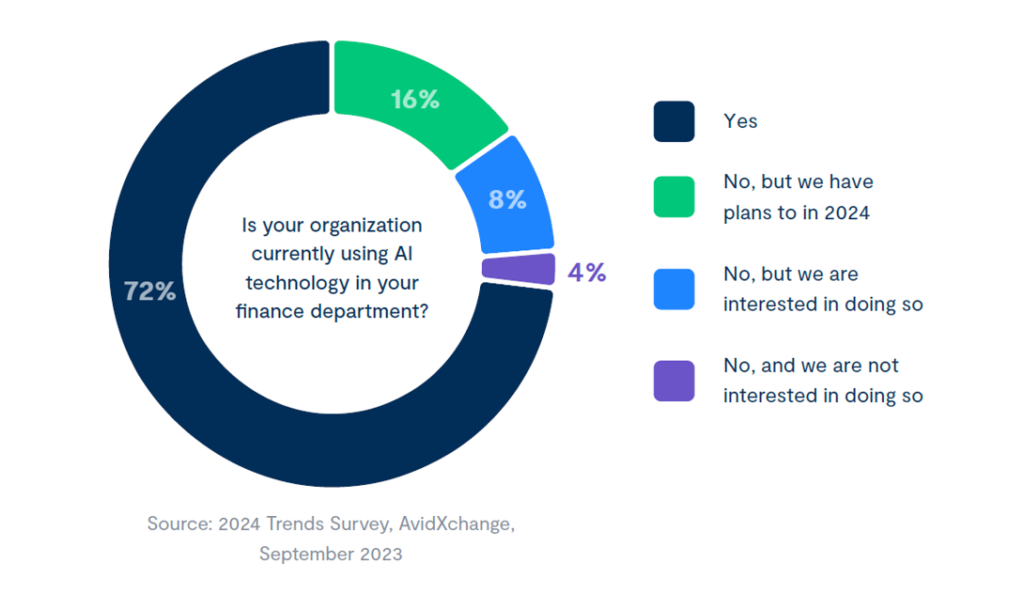

AI Adoption in Finance Departments

According to an AvidXchange Survey, 72% of finance departments are already utilizing AI, with others planning to adopt it soon. The most popular AI tools in finance include Natural Language Processing (NLP) and Computer Vision, which are used for tasks like extracting and entering financial data from documents.

Advantages of Using Artificial Intelligence in Wealth Management

- Tailored Client Solutions: AI enables the creation of unique, data-driven experiences for clients, offering a digital onboarding process that feels personal and appealing.

- Immediate Insights for Advisors: This technology assists both advisors and their clients in making well-informed decisions by providing up-to-the-minute information.

- Forecasting Analytics: AI’s predictive capabilities bring a new edge to investment strategies, focusing more on outcomes than traditional approaches.

- Efficient Prospecting: Leveraging AI, firms can sift through large datasets to categorize potential clients more effectively, enhancing their client acquisition strategy.

- Customization of Investment Options: AI allows for the adjustment of investment plans to fit individual client profiles, streamlining the process of identifying specific client needs.

- Advanced Automation in Managing Wealth: Routine and repetitive tasks can be delegated to AI systems, freeing up time for employees to focus on complex and high-priority tasks.

- Simplified Regulatory Compliance: AI tools are adept at keeping pace with fast-changing industry regulations and legal requirements, making compliance management more efficient.

- Enhanced Decision-Making Processes: By utilizing AI, wealth management firms can delve deeper into customer data and market changes, leading to more effective and strategic decision-making.

Revolutionizing Customer Service with Generative AI

In the realm of finance, generative AI is spearheading a shift from traditional methods of customer service to more advanced, AI-driven platforms. These technologies have become essential in providing a more human-like interaction experience, making AI agents the first point of contact in most inquiries. This not only elevates the customer experience but also streamlines operational processes by minimizing the need for human involvement in routine queries.

To ensure the effectiveness of these AI models, financial institutions are investing heavily in training and data management. The goal is to transform these models from mere technological novelties to fundamental enhancements in customer service. This involves meticulous data and metadata management, ensuring that AI systems have access to current and relevant information, all while maintaining stringent data governance and compliance protocols.

Transforming Chatbots into Financial Advisors

In the near future, AI-driven chatbots are expected to play a pivotal role in wealth management. Predictions indicate that a significant portion of new clients will seek data-driven, personalized advice, akin to the convenience they experience with services like Netflix and Amazon. In response, financial entities like J.P. Morgan Chase and One Zero Bank are utilizing AI to evolve their chatbots into more intuitive and engaging platforms, capable of understanding and anticipating consumer needs. This advancement in AI technology is enabling the creation of personalized client profiles and user experiences that surpass traditional in-person interactions.

AI-Enhanced Decision Making and Wealth Management

The evolution of robo-advisors signifies a leap from limited personalization to a more tailored approach facilitated by machine learning. Banks and wealth management firms (e.g., Moneyfarm, Deutsche Bank, Ally Bank, Credit Suisse Digital, etc.) are either developing custom robo-advisors or partnering with existing ones to offer more accessible and diversified services to their clients. These services are not just limited to investment management and retirement planning, but also extend to areas like tax optimization, ESG investment, and socially responsible investing (SRI).

Hybrid models that combine human expertise with automated technology are also emerging. These models allow for the formulation of comprehensive strategies and step-by-step plans for various financial scenarios, offering a more holistic approach to wealth management.

Personalized Portfolios through AI

The conventional “one-size-fits-all” model portfolios are being replaced by AI-driven personalized portfolios. These AI algorithms can cater to a wide range of individual preferences, especially in areas like ESG, which have become increasingly important to investors. By aligning investment strategies with personal values and priorities, AI is enabling a more impactful and individualized investment experience.

Case Studies in AI-Driven Wealth Management

Enhancing Advisor-Client Alignment at Morgan Stanley

Morgan Stanley’s Wealth Management Unit innovatively leveraged AI through their “Next Best Action” system. This AI-powered solution assists financial advisors in aligning investment recommendations precisely with each client’s profile. The system not only improves the precision in investment offerings but also identifies clients’ interests, leading to better engagement and satisfaction.

AI in Fraud Detection and Cybersecurity

AI is crucial in real-time detection of unusual patterns and potential fraud, thereby securing financial transactions. For instance, JPMorgan Chase employs AI-driven systems for detecting and preventing fraudulent activities and cybersecurity threats.

Revolutionizing Online Trading with Robinhood

Robinhood, a leading online trading platform, stands out with its zero-commission model. The platform utilizes AI to deeply understand client profiles and predict investment returns with high accuracy. Its predictive algorithms are adept at identifying clients at risk of leaving, allowing Robinhood to proactively engage and retain them.

Enhancing Client Relationship Management

AI tools are instrumental in segmenting clients based on their behaviors, preferences, and needs. This leads to more effective and personalized communication strategies. A prime example is Salesforce Einstein AI, which equips wealth managers with deeper insights into client needs and preferences.

Growth through Automation: The Wealthfront Experience

Wealthfront, known for its automated investment services, saw a significant increase in user sign-ups, attributing to a 68% growth during the pandemic. Their robo-advisory platform, providing digital investment management and financial planning, gained acclaim for its comprehensive decision-making automation. Post-2021 updates further enhanced investor control within the platform, solidifying its position in the market.

Boosting Operational Efficiency and Automation

AI’s role in automating routine tasks like data entry, report generation, and compliance checks cannot be overstated. This technology frees wealth managers to focus on more complex and strategic tasks. UBS, for example, employs AI to streamline various operational processes, enhancing efficiency and accuracy.

Streamlining KYC Processes with AI

The traditional approach to KYC (Know Your Customer) processes, often cumbersome and prone to errors, has been transformed by AI. The introduction of the AI-powered data-extraction tool, Magic Deep Sight, significantly reduced manual data analysis efforts by 70%. This tool is also applied in automating other financial operations like invoice processing and fund accounting.

Ernst & Young’s Cloud-Based AI Solution for Compliance

Ernst & Young developed “SARGE,” a cloud-based AI system that efficiently extracts and analyzes information from governance contracts, automatically identifying potential liabilities. While not fully autonomous, this system has remarkably reduced the workload for compliance managers by 75%.

Personalized Financial Planning

AI-powered tools enable dynamic and accurate financial planning, leveraging real-time data and predictive analytics. Vanguard’s Personal Advisor Services is a notable example, combining AI algorithms with human expertise to offer customized financial planning.

Conclusion

The integration of AI in finance is more than just a technological upgrade; it represents a paradigm shift in how financial services are delivered and experienced. From enhancing customer service through generative AI to redefining wealth management with personalized strategies, AI is setting a new standard in the financial industry. As we move forward, the role of AI in finance will continue to grow, offering more sophisticated, customized, and efficient solutions that meet the evolving needs of clients and the industry at large.