WealthFollow.me

Case study: Transforming Client Engagement in Wealth Management

Category

- Fintech

- Market Making

- Wealth Management

Project Overview

Wealth management firms face the twin challenges of attracting and retaining clients, particularly among a new generation of investors who demand personalized services and deeper involvement in their investment decisions. To address this, we introduced WealthFollow.me, a pioneering wealth management tool that transforms how investment portfolios are managed and presented to clients.

Product Description: WealthFollow.me is comprised of two key components designed to enhance client engagement and personalize asset management:

- Client Testing and Profiling: This initial phase involves a detailed analysis of the client’s financial preferences and goals. Through sophisticated testing and profiling, we tailor communication and portfolio presentations to match each client’s unique financial personality.

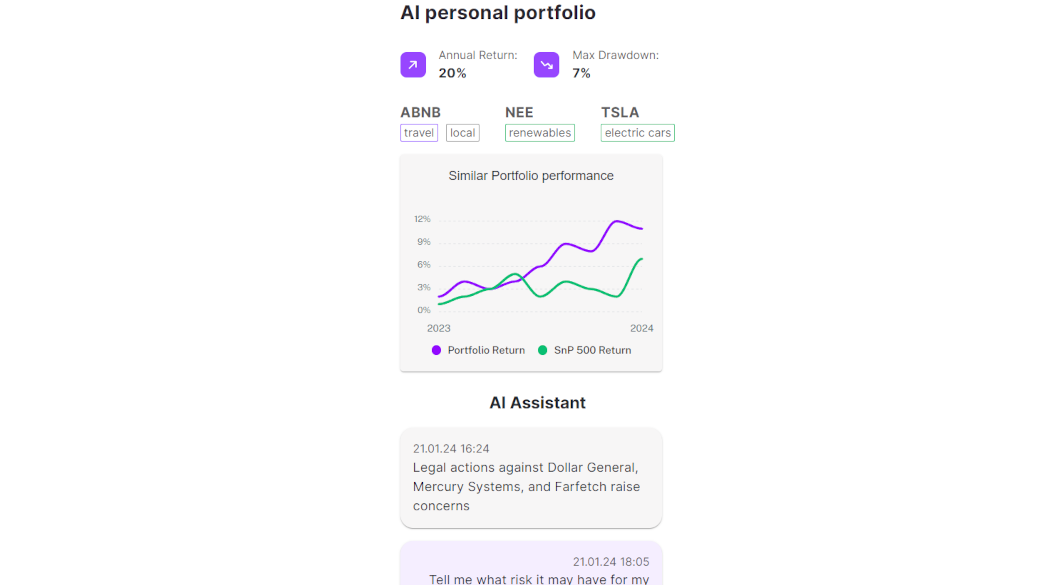

- Personalized Portfolio Management and Communication: Our AI-driven platform not only manages personalized investment portfolios but also enriches client interaction by providing dynamic, engaging report about the investments.

Universal Application Across Financial Institutions: WealthFollow.me is engineered to support a wide array of financial entities, from banks and asset managers to family offices and trading platforms. The solution is adept at managing portfolios of any size, offering tailored asset management solutions for retail client assets ranging from as little as $10 million to as much as $1 billion.

Problem Solved: WealthFollow.me addresses the critical industry challenge of client attraction and retention. Traditional wealth management services often lack personalization and fail to engage the modern investor who seeks more control and a personalized touch in asset management.

Solution: WealthFollow.me offers a personalized AI asset management assistant that transforms standard investment management into an interactive, client-focused experience. Clients receive customized reports and updates that make the financial data not only accessible but also engaging, ensuring that clients feel connected and informed about their investments.