QuantCortex.ai

Case study: AI-Powered Portfolio and Asset Management

Category

- Fintech

- Market Making

- Wealth Management

Project Overview

Challenge: The complex and time-consuming process of stock portfolio management often requires months of detailed analysis and decision-making.

Solution: QuantCortex revolutionizes portfolio management by harnessing the power of AI and ML, condensing the lengthy research and analysis process into mere weeks. Our innovative software offers:

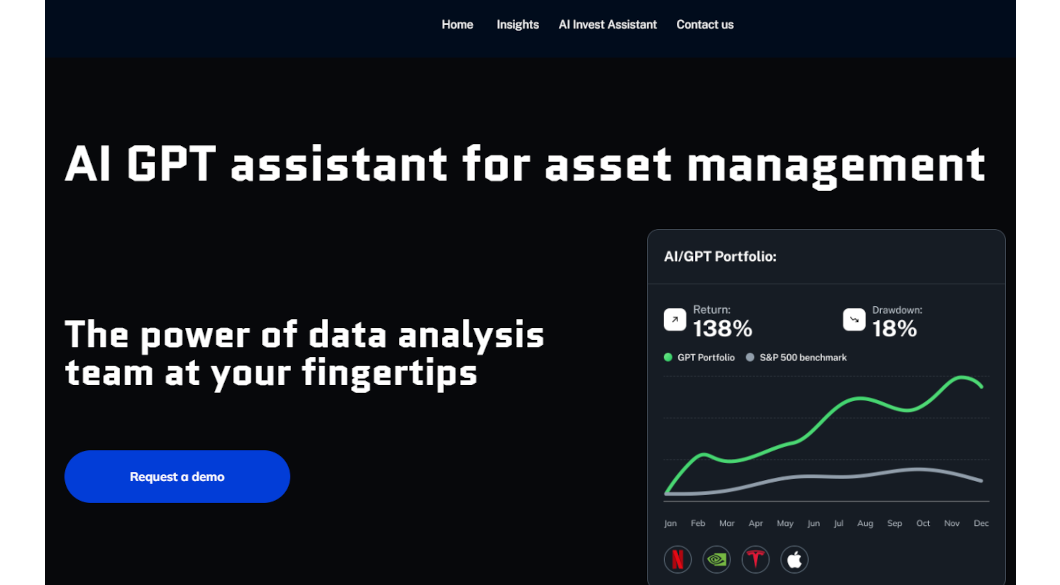

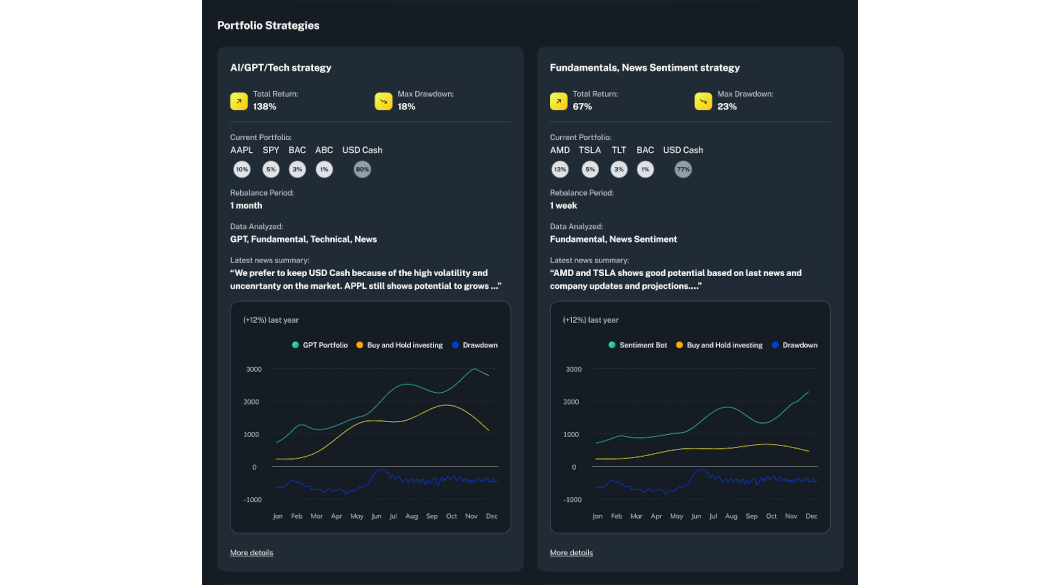

- AI Portfolio Management Strategies: By applying advanced AI to historical and real-time data — alongside news sentiment and expert ratings — QuantCortex provides strategies designed to outperform the market.

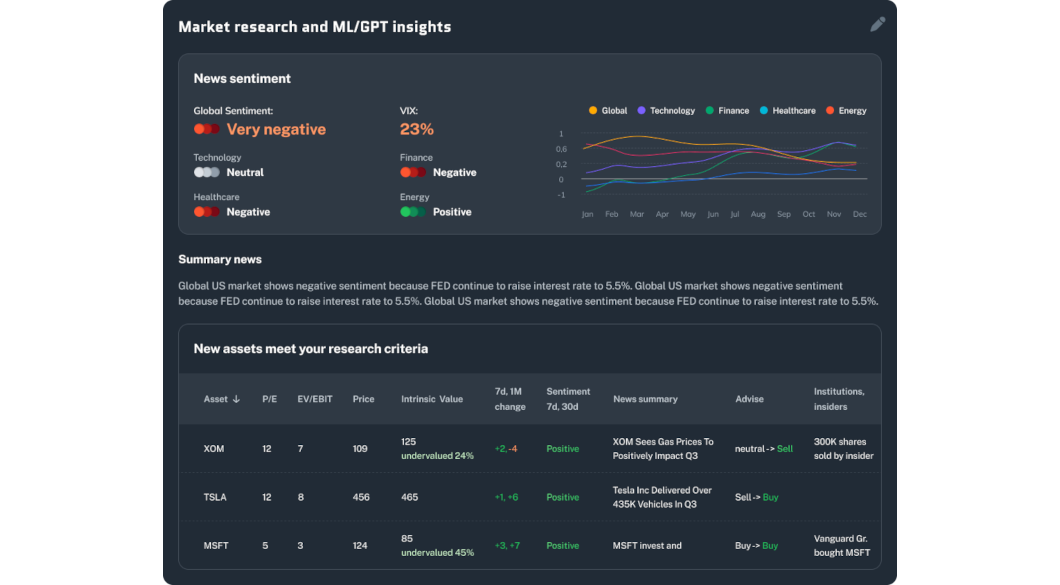

- Accelerated Market Research: With the capability to analyze billions of data points for over a thousand assets almost instantaneously, our AI assistant outpaces human abilities, offering rapid, comprehensive market research.

- Immediate Insights & Alerts: Users receive real-time insights and portfolio rebalancing alerts, facilitating timely decisions to optimize profit margins.

- Exclusive Data Access: QuantCortex grants access to unique data streams including news sentiments, ML predictions, and expert ratings, enriching the user’s market understanding.

Impact: QuantCortex users gain a competitive edge by leveraging AI-driven insights to make informed decisions swiftly. The platform’s comprehensive data analysis, coupled with real-time rebalancing alerts, empowers users to manage their portfolios proactively, leading to enhanced profitability and market performance.

Transform your trading strategy with QuantCortex — where AI meets human intuition to redefine stock portfolio management.