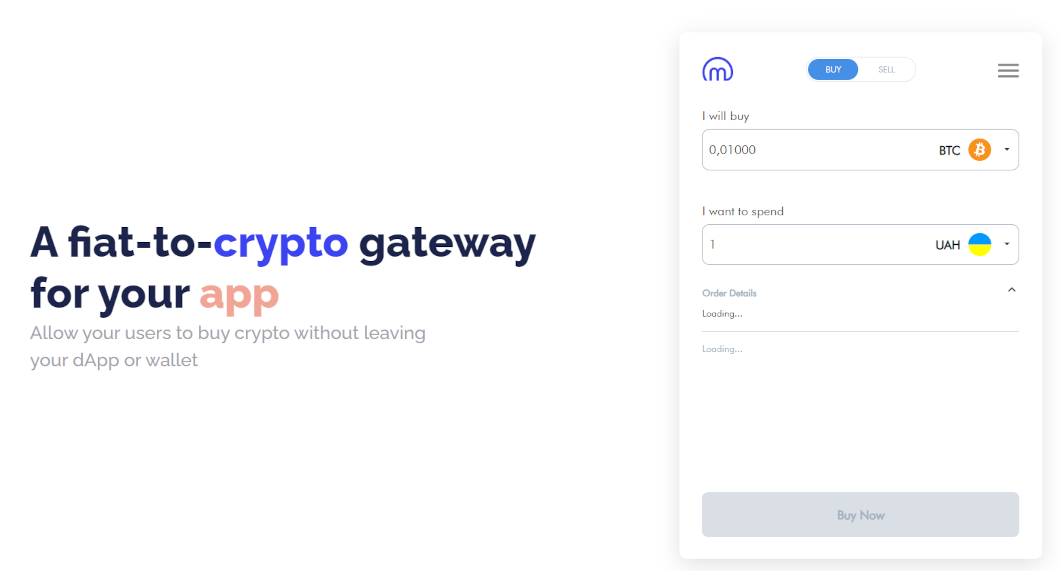

Mobilium

Case study: market making and HFT scalable architecture

Category

- Fintech

- Market Making

- Crypto Trading

Project Overview

Our team undertook a transformative project in the finance and trading sector, where the need for speed and scalability was paramount. The goal was to create a robust, high-frequency trading platform capable of handling millions of records daily. Leveraging cutting-edge technologies, we engineered an architecture that met these demands.

Challenges

- Handling a massive volume of trading data efficiently.

- Implementing comprehensive strategy automation.

- Ensuring seamless backtesting and paper trading capabilities.

- Achieving lightning-fast order execution.

- Implementing smart order execution algorithms.

- Managing iceberg order execution to optimize large trades.

Our Solutions

- Scalable Architecture: We designed and implemented a highly scalable architecture that could effortlessly process millions of trading records per day, ensuring real-time data availability and processing.

- Strategy Automation: We automated trading strategies, enabling traders to execute orders swiftly and precisely. This automation significantly reduced manual intervention, minimizing errors and enhancing efficiency.

- Backtesting and Paper Trading: Our platform included robust backtesting and paper trading functionalities, allowing traders to evaluate strategies in simulated environments before going live.

- Order Execution: We achieved rapid order execution, ensuring that trading decisions were executed within milliseconds, which is crucial in high-frequency trading.

- Smart Order Execution: Our smart order execution algorithms were designed to optimize trade execution, providing traders with the best possible outcomes.

- Iceberg Order Execution: We implemented iceberg order execution techniques to efficiently handle large orders while minimizing market impact.

Technologies Used

Our team employed a tech stack tailored to meet the specific requirements of this high-frequency trading platform:

- Node.js: For fast and event-driven backend development.

- React: For building a dynamic and responsive user interface.

- Kafka: For real-time data streaming and processing.

- MongoDB: As the database to store and retrieve trading data.

- Docker: For containerization and seamless deployment.

- Kubernetes: To orchestrate containerized applications and ensure scalability.

Would you like to explore more of our portfolio cases? Feel free to reach out for further details or to discuss how we can tailor our solutions to your unique needs.